Forecasting for investments and depreciations is, even today, usually done in Excel. This can work fine when you have relatively few investments to keep track of, but apart from the usual problems with Excel – copying and pasting data between different spread sheets for example – additional challenges arise when forecasting investments and depreciation. In this article, we will go over the difficulties that can arise and how they can be managed with a system for budget and forecasting.

In this article I'll talk about

- Challenges in Excel

- Simplify and streamline with a modern system

- What separates Planacy from other budgeting systems?

Challenges in Excel

To avoid far too much manual labor in Excel, many people tend to budget a lump sum for their investments. The disadvantage of this, however, is that the follow-up suffers – analysing deviations for the investment costs becomes difficult if one does not distinguish the different investments in the budget.

Another challenge when working in Excel is managing depreciation, especially regarding the period in which the asset is to be depreciated. Every year, a manual update must be made in Excel so that the value of the asset is up to date, and the depreciation is correct. In addition to the time aspect, the risk of errors therefore increases, and it becomes even more complicated if more depreciations are added, or if any existing assets are sold off.

Simplify & Streamline With a Modern System

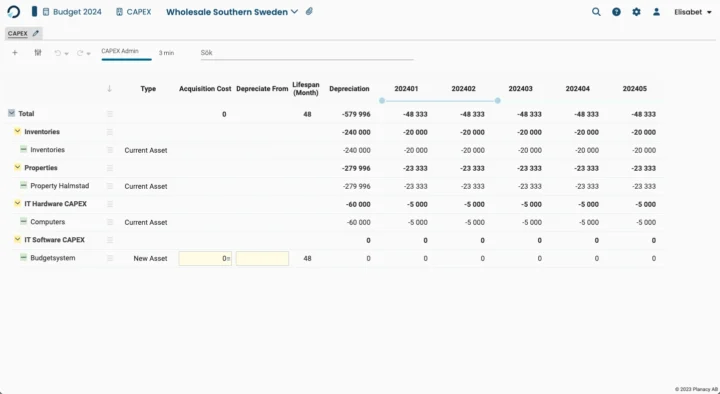

With a modern system for budgeting and forecasting, you can automatically retrieve current assets from the fixed assets register, regardless of whether you use an advanced system or store the fixed assets register in Excel. In this way, you always get a clear and updated overview of your assets, as well as depreciation of current assets.

In Planacy, such an overview could look something like the image below: