How to Implement Zero-Based Budgeting

Implementing zero-based budgeting might seem daunting, but with a structured approach, it can deliver significant benefits. Here’s how to get started:

1. Start from Zero

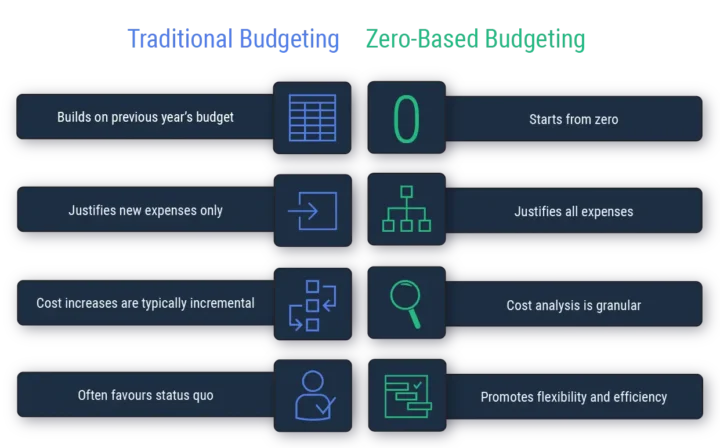

In ZBB, each department must begin by justifying its entire budget from scratch. This process eliminates assumptions based on last year's numbers and forces a critical inspection of every cost.

2. Identify Key Functions and Costs

Break down the organisation into functional areas and outline the activities necessary for achieving business objectives. From there, list the associated costs and group them based on priority and necessity.

3. Justify Every Expense

Each department must provide a justification for every line item. This involves showing the return on investment or how the expense aligns with strategic goals. Costs that don’t deliver value are either reduced or eliminated.

4. Prioritise Expenditures

After the justification process, rank expenditures based on importance. This ensures that essential activities are fully funded, while less critical ones might be scaled back or cut entirely.

5. Review and Approve

Managers review all the submitted budgets, cross-check for alignment with overall business goals, and make necessary adjustments. Once satisfied, they approve the final budget.