Why can the traditional budget be a problem?

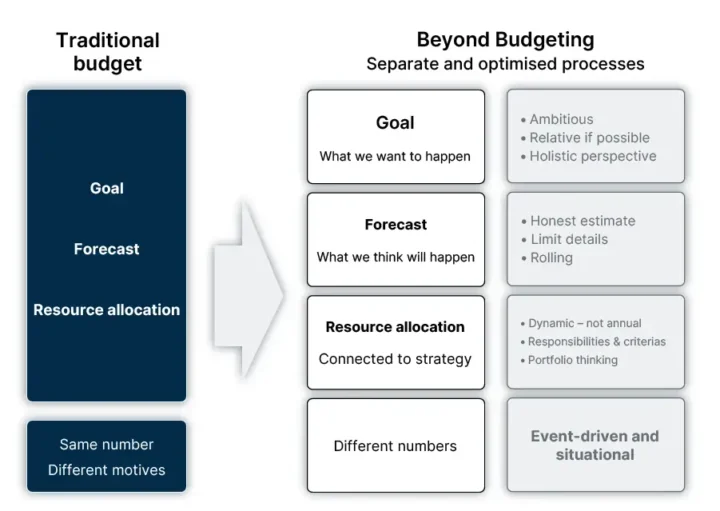

The budget is a classic instrument which must align with the overall business plan, allocate resources and bring the business closer to the set goals. However, few people actually experience that the budget lives up to all of this. It can often be perceived as rather inhibiting and counterproductive – especially when it comes to bringing the business closer to its goals.

Working towards a fictitious deadline with an established framework can in some cases be beneficial, but unfortunately it can also lead to a lot of missed opportunities along the way. In addition, it becomes hard to adapt your business in the pace that’s needed to really be able to execute towards the long-term business plan or short-term goals.

For example: due to external factors, the budget for travel expenses has been maxed out even though there’s still time left before the fictitious deadline. You therefore try to save money by restricting the travel budget and thus risk missing out on opportunities – which in a worst-case scenario can be income- and growth inhibiting. Another example is when you decide to stop all recruitment processes since you’ve hit the ceiling for HR- and staff expenses because the replacement recruitments cost more than you had budgeted for.

The budget was kept – but was it the best thing for the business in the long run?

Another common criticism of the traditional budget is that it often becomes obsolete even before the board has had a chance to vote on it. The world we live in right now is changing faster and is more unpredictable than ever before and therefore, the need for agile and dynamic business management is growing.